Check your refund status

Chequea el estado de tu reembolso

Check your refund

Before you start, you will need the following information:

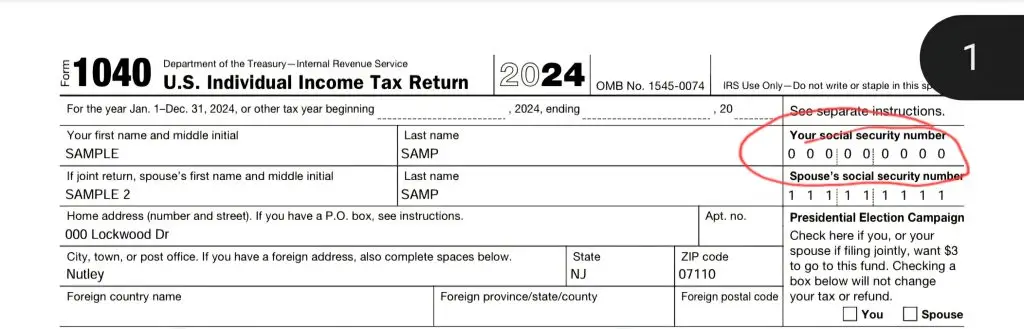

* Social Security number/ITIN.

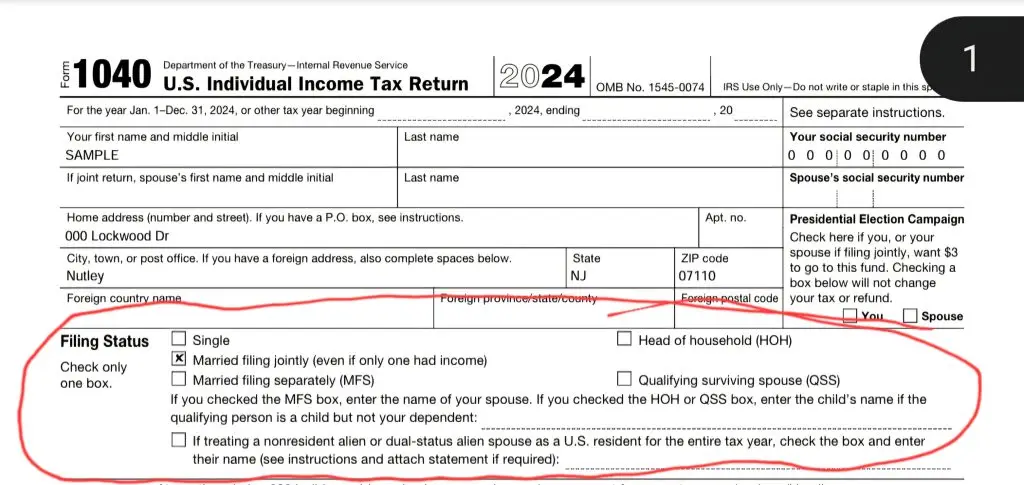

* Filing Status

NOTE: How did you file your status for the specific year you want to check?

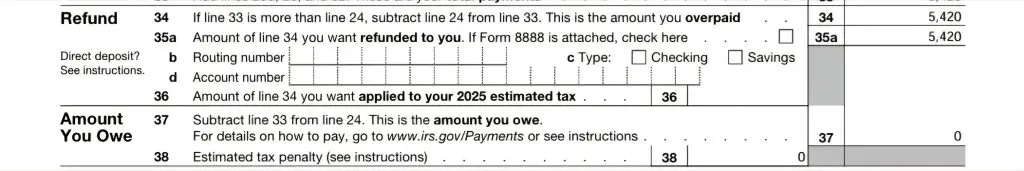

* Refund Amount

Antes de comenzar, necesitará la siguiente información:

* Número de Seguro Social/ITIN.

* Estado civil

NOTA: ¿Cómo presentó su estado para el año específico que desea verificar?

* Monto del reembolso

Look at the page: it says "1040" on the left, along with the tax year.

Mire la página: dice "1040" a la izquierda, junto con el año fiscal.

* Social Security number/ITIN - Número de Seguro Social/ITIN.

* Filing Status / Estado civil

* Refund Amount - Monto del reembolso

When does the IRS typically send refunds?

Most IRS refunds are issued within 21 days of the IRS receiving your e-filed tax return. Paper returns may take six to eight weeks. Refund timing can vary depending on the accuracy of your return, additional reviews, or any issues that may require further processing. Estate typically issues your refund after the IRS issues yours.

Why would the IRS/State hold your return?

Remember, if the IRS holds your refunds, it may be for different reasons such as Identity Verification, Review of Credits (Earned Income Tax Credit (EITC), Additional Child Tax Credit (ACTC), American Opportunity Credit), Income Doesn’t Match Their Records, Past-Due Debts – your refund may be held or reduced to pay: Child support, Student loans, State taxes, or Other federal debts. Random Review, Suspected Fraud. In any of those cases, the IRS or the State will send you a letter, or when you check your refund status, it will show a note explaining the reason for the hold.

Please check your mail for any letters. If you receive any letters (IRS / State), remember the email we sent with your tax copies, which has a lot of information, including links and phone numbers, to help you with your letters or questions.

¿Cuándo suele enviar el IRS los reembolsos?

La mayoría de los reembolsos del IRS se emiten dentro de los 21 días posteriores a la recepción de su declaración de impuestos presentada electrónicamente. Las declaraciones en papel pueden tardar de seis a ocho semanas. El plazo de reembolso puede variar según la precisión de su declaración, revisiones adicionales o cualquier problema que requiera un procesamiento posterior.

¿Por qué el IRS/Estado retendría su declaración?

Recuerde, si el IRS retiene sus reembolsos, puede deberse a diferentes razones, como verificación de identidad, revisión de créditos (Crédito Tributario por Ingreso del Trabajo (EITC), Crédito Tributario Adicional por Hijos (ACTC), Crédito por Oportunidad Estadounidense), ingresos que no coinciden con sus registros, deudas vencidas (su reembolso podría ser retenido o reducido para pagar: manutención infantil, préstamos estudiantiles, impuestos estatales u otras deudas federales), revisión aleatoria o sospecha de fraude. En cualquiera de estos casos, el IRS o el estado le enviarán una carta o, cuando revise el estado de su reembolso, se mostrará una nota explicando el motivo de la retención.

Por favor, revise su correo para ver si hay alguna carta. Si recibe alguna carta (del IRS o del estado), recuerde el correo electrónico que le enviamos con sus copias de impuestos, que contiene mucha información, incluyendo enlaces y números de teléfono, para ayudarle con sus cartas o preguntas.

Have you checked your State Refund? At the bottom, you would see all the state names. Choose your tax state

As soon as you click the name of your state link, it will take you to a new page for each state where you have to find where it says “Where is my refund” click there and put your information.

Keep in mind that sometimes the State will require you to create an account. It may ask for the amount of your refund which would appear in the copies that you received when you files your taxes.

If for any reason, you don’t find it or have any questions about your refund amount contact us.

Note: Keep in mind that there are some states that are not on the below list because that does not require any taxation.